Cash flow hedges Net losses arising on hedges recognised in OCI 62 53 Net amount reclassified to the profit or loss 21 IAS191 Income tax relating to these items 6 4 Items that will not be reclassified to profit or loss IAS17d IFRS720avii Net gains on investments in equity instruments designated at fair value. 4 Return on capital is a non.

Hedges Of Recognized Foreign Currency Denominated Assets And Liabilities The Cpa Journal

Like the list above unrealized gains and losses from cash flow hedges Cash Flow Hedges A cash flow hedge is an investment method to control and mitigate the sudden changes in cash inflow or outflow to the asset.

. IAS 39IFRS 9 and the effective portion of gains and losses on hedging instruments in a cash flow and net investment hedges IAS 39. 2 days ago3 Profit Margin is a non-GAAP financial ratio defined as net earnings for the quarter divided by revenue before royalties but including realized hedging gainslosses. Changes in revaluation surplus IAS 16 IAS 38 actuarial gains and losses on defined benefit plans IAS 19 gains and losses arising from translating the financial statements of a foreign.

Colgate Gains losses on cash flow hedges included in other comprehensive income is 7 million pre-tax and 5 million post-tax.

Derivatives And Hedging Accounting Vs Taxation

Cash Flow Hedge Of A Net Position Annual Reporting

How Are Gains And Losses From Cash Flow Hedges Reported In The Financial Statements Universal Cpa Review

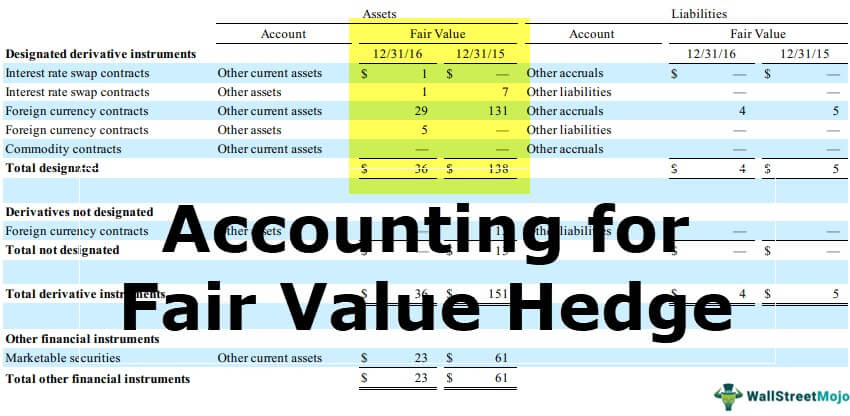

Accounting For Fair Value Of Hedges Examples Journal Entries

0 Comments